Introducing Stoqs

Market insights with

natural language

Start by asking anything

0 Latency

Live data <=1 min latency

5 Markets

NYSE, Nasdaq, OTC Markets, BSE and NSE

15+ Years

Historical Market Data

Introducing Stoqs

Start by asking anything

Live data <=1 min latency

NYSE, Nasdaq, OTC Markets, BSE and NSE

Historical Market Data

Faster and simpler workflows

Supercharged insights that you can rely on - all the way to the bank.

Streamlined investment workflows

How can we use 14-day Relative Strength Index, 14-day Average Directional Index, and 50-day EMA to predict potential trend reversals or continuations for NVIDIA? What do these indicators collectively suggest about the stock’s future price movement?

How do Walmart and Target compare in terms of market cap, profitability, and customer loyalty? What strategic changes could they consider improve their position?

Inference and Reasoning

Stoqs does not rely solely on LLMs for reasoning and inference, but also uses traditional analytical tools.

Compare the segment sales for AMD between 2022 and 2023. which segment's sales increased the most proportionally?

Plot the triple ema and the ema of apple stock, with a period of 23 and 14 respectively

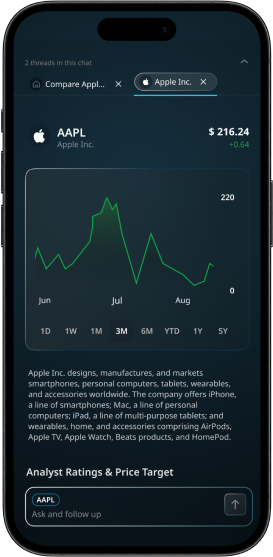

Generative UX delivers accurate, detailed in-house charts and graphs without third-party providers

Trustworthy, institutional-grade data from reliable sources — relevant insights over popular ones

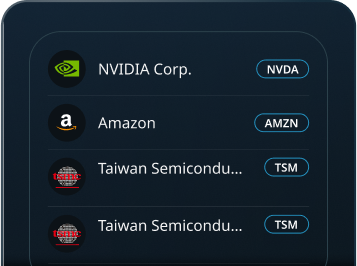

The watchlist feature lets you extract insights from the stocks you're interested in, just through chat

On tests using Finbench, Stoqs beats other LLM products on finance queries. Our refined retrieval strategies make this possible.

Introducing the next generation of

interactive experience

Too many options to explore? Explore them all.

With threads, you can research multiple stocks and news.

Start a new thread on Stoqs

Why should Wall Street have all the fun?

Access institutional grade financial insights with Stoqs.